MAS Foundation is a philanthropic organisation, which honours the principles of Te Tiriti o Waitangi, and is committed to improving health and wellbeing equity in Aotearoa New Zealand.

Our Whakapapa

In 2019 MAS (Medical Assurance Society), an insurance and investment provider, established MAS Foundation to make an even more meaningful difference to a healthier Aotearoa New Zealand. This was wholeheartedly endorsed by MAS Members who voted in favour of establishing the Foundation.

Find out more about the journey of MAS Foundation, from its inception, and the difference it is making to our communities.

What we fund

Our approach to grantmaking is relational – we aspire to engage in high-trust relationships grounded and led by our values, which shape our actions.

Change to communities, programmes and initiatives we have funded

Wairoa Te Ohonga Ake

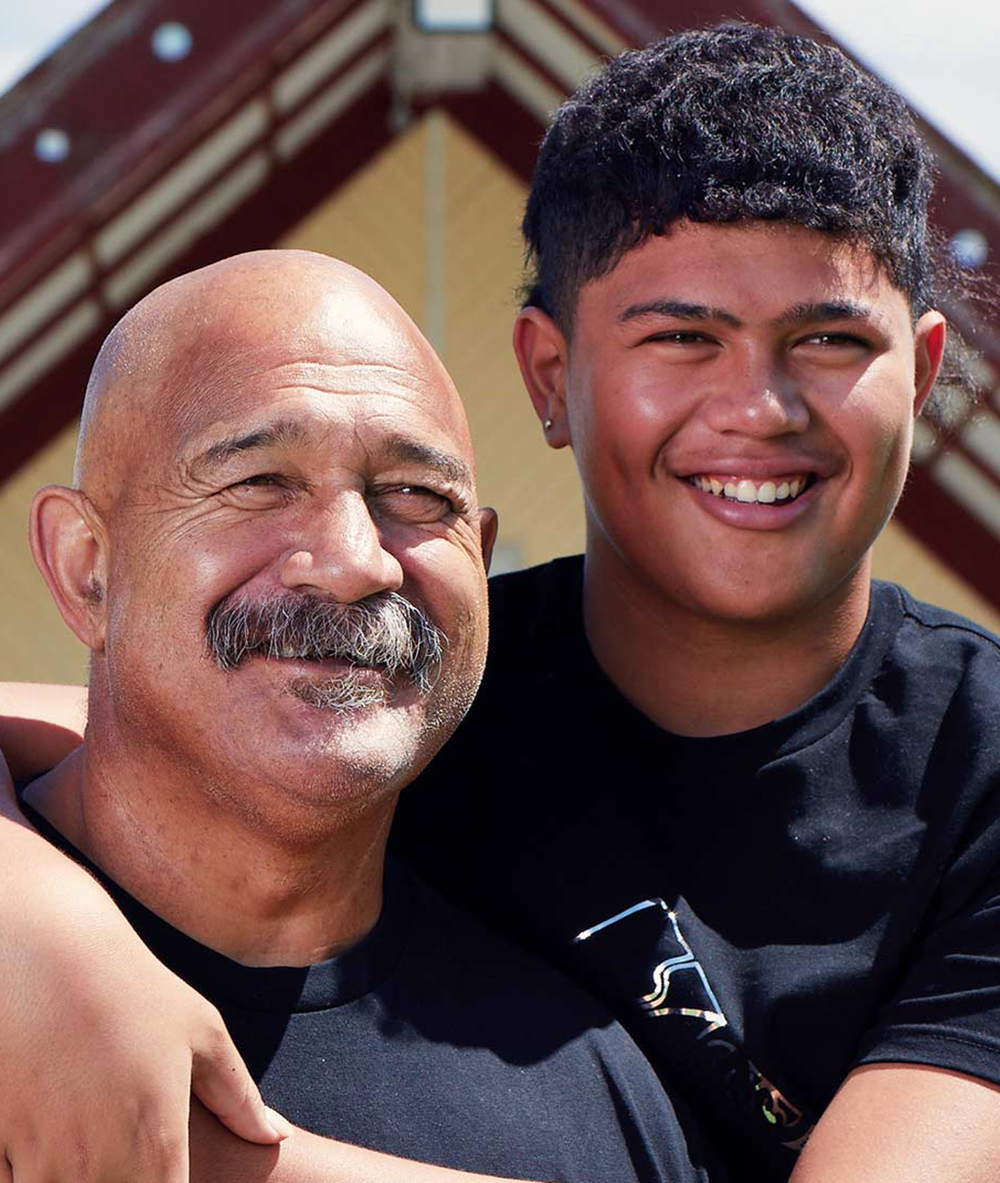

Forging paths for future leaders

Supporting and developing the future generation to reduce health and wellbeing inequities and break the mould for rangatahi in Te Wairoa to become our future leaders.

Read story

PADA – Perinatal Anxiety & Depression Aotearoa

Improving outcomes for hapū māmā and whānau

Enquire for funding

Get in touch with us to see if your mahi is a good fit with MAS Foundation.

Enquire