Those who read last month’s investment market commentary will be familiar with the sudden market drop at the beginning of August and what caused it. Even though this was covered in July’s commentary, we believe it’s important to provide another update as it illustrates an important lesson for investors.

So, here’s a quick summary. Global share markets dropped suddenly at the start of August, seemingly triggered by unexpectedly weak US economic data. This raised concerns that the US Federal Reserve may have left it too late before cutting interest rates. This, coupled with modestly disappointing earnings results (relative to very high expectations) of large US technology companies, saw investor sentiment sour.

The Japanese share market was the main outlet for investor anxiety. This was mainly due to market positioning, excessive leverage and a central bank that unexpectedly lifted interest rates. After the first 3 trading days in August, Japan’s Nikkei 225 Index was down 20% (all returns are in local currency terms unless stated). On one of those days, the Nikkei 225 index had its biggest one-day fall (down more than 12%) since 1987. This weakness spilled into other markets, with global equities, as measured by the MSCI All Country World Index, falling around 6% over the same period.

This all sounds doom and gloom, so what’s the important lesson for investors? The lesson is not to panic when noise creates short-term volatility. Investors should always keep the focus on their long-term investment horizon. Yes, the share market drop in August was sudden, but it was over in only 3 days. Fast forward to the end of August, we see that the global share market more than fully recovered these losses. If investors sold their shares close to the bottom, they would have missed out on all the gains in the upswing. Always keep your long-term investment horizon as your main focus and remain invested in line with your appropriate risk profile. Our Fund Finder or a MAS Adviser can help you check if you're in the right fund for your circumstances.

After the initial commotion at the start of August, it was relatively plain sailing for the rest of the month, with share markets around the world steadily recovering. For the month overall, the MSCI All Country World Index returned +1.8%, led by the US share market (S&P 500 index) which gained +2.4%. The US Federal Reserve (Fed) Chair helped investor sentiment by acknowledging that “the time has come for policy to adjust”. This implied that interest rates are likely to be cut at its September meeting. The Fed also left the door open for a 0.50% rate cut, as opposed to the usual 0.25%. While most share markets fully recovered from the initial drop at the start of August, the Japanese market wasn’t quite as robust. The Nikkei 225 index ended the month down marginally, as concerns lingered that the Bank of Japan remained firm on its stance on lifting interest rates.

Despite positive returns over the month from most share markets around the world, earnings results for the large US technology companies were mixed in August. A good example of this was Nvidia, which delivered earnings per share ahead of forecast and upgraded its guidance. Following the announcement, the company’s share price immediately fell 6%, illustrating the lofty expectations some investors have for these AI related companies. Despite this setback, Nvidia’s shares ended +2.0% higher over the month.

The Australian and New Zealand share markets both ended higher over the month, with the former following a similar trend as other global markets. Like most global markets, the New Zealand share market rebounded strongly following the initial drop at the start of August. Its recovery took the index up +4% from its monthly low, supported by the Reserve Bank of NZ’s (RBNZ) interest rate cut. However, the domestic index was unable to hold on to most of the gains, finishing the month up +0.34%.

Bond yields were mixed over the month. In the US, yields fell (yields move in the opposite direction to price) as soft economic data supported a September rate cut from the Federal Reserve. The yield on the US 10-year Treasury bond ended the month at 3.90%, down 0.13%, while the UK equivalent finished up 0.05% at 4.01%.

In NZ, the RBNZ ended its flip-flop messaging by cutting the official cash rate by 0.25%, down to 5.25%. Many now expect inflation to fall back within the 1% to 3% target band in the September quarter. This saw bond yields drop, and domestic bonds produce a positive return over the month. Immediately after the RBNZ’s announcement, major banks followed by reducing lending rates, providing much needed relief for mortgage holders. The yield on the NZ 10-year Government bond finished the month at 4.27%, down 0.07%.

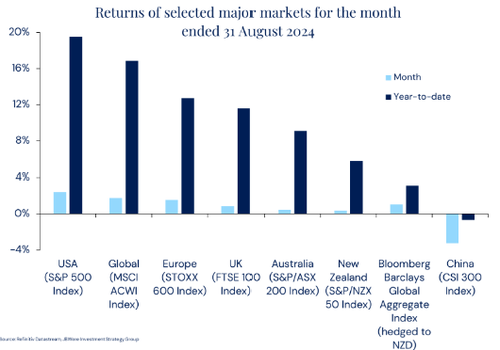

The differing fortunes of various asset classes are illustrated in the chart below.

Note: Returns are in local currency terms.

The outlook

Over the past couple of years, the 2 defining features of the global economic and financial market landscape have been the outperformance of the US economy and the strong returns delivered by the world’s largest technology companies. Our lead investment manager JBWere, sees both now being at interesting junctures. Firstly, the US economy is finally cooling. It is quite plausible that it avoids a more dramatic slowdown (i.e. recession), which is a clear risk if the labour market deteriorates sharply. This would then call into question the expectations for future corporate earnings that have been built into current share prices. There has also been a few more questions emerging recently regarding the expectations for large technology companies. This includes how quickly they will be able to monetise the large amount of capital expenditure they’ve spent on new exciting technologies like artificial intelligence. Those questions are unlikely to be answered immediately, but JBWere likes the high-quality attributes and growth these companies still offer.

We are always looking for catalysts to turn more constructive on equity markets. However, with the turbulent geopolitical landscape, a key US election only months away, and uncertainty as to where interest rates will settle over the long run, we believe it is prudent to maintain a conservative view towards the outlook for investment markets. Our preference for the MAS Schemes is for quality investments that should be better placed given the uncertain backdrop and expected bouts of volatility likely over the coming months. That said, we continue to seek and take advantage of opportunities when they present themselves. For example, opportunities in equities where relative sentiment is beginning to shift more positively (like in the New Zealand market for example).

We have useful online tools to help you:

- Our Fund Finder can help you see if you're in the right Fund for your circumstances.

- Our KiwiSaver Retirement Calculator can help you understand if your retirement savings are on track.

- Our MAS Investor Portal can help you manage your investments online.

If you decide to change your Fund after reviewing your risk profile or meeting with a MAS Adviser, you can make a switch via the MAS Investor Portal, or alternatively you can complete an investment strategy change request form. There is no fee for switching. Links to the relevant forms are below.

- MAS KiwiSaver Scheme: KiwiSaver Documents and Forms – MAS

- MAS Retirement Savings Scheme: Retirement Savings Scheme Documents and Forms – MAS

- MAS Investment Funds: Investment Funds Documentations and Forms

You can see weekly updates on fund unit prices and returns on our website:

- MAS KiwiSaver Scheme: KiwiSaver Funds – MAS

- MAS Retirement Savings Scheme: Retirement Savings Scheme Funds | MAS – MAS

- MAS Investment Funds: Investment Funds – MAS

This article is of a general nature and is not a substitute for professional and individually tailored advice. Medical Funds Management Limited, JBWere (NZ) Pty Ltd and Nikko Asset Management New Zealand Limited, their parent companies and associated entities do not guarantee the return of capital or the performance of investment funds. Returns indicated may bear no relation to future performance. The value of investments will fluctuate as the values of underlying assets rise or fall.

MAS is a financial advice provider. Our financial advice disclosure statement is available by visiting mas.co.nz or by calling 0800 800 627.

The Product Disclosure Statement for the MAS KiwiSaver Scheme is available: KiwiSaver – MAS

The Product Disclosure Statement for the MAS Retirement Savings Scheme is available: Retirement Savings Scheme – MAS

The Product Disclosure Statement for the MAS Investment Funds is available: Investment Funds – MAS

Medical Funds Management Limited is the issuer and manager of the Schemes.

More news

New team of in-house motor assessors at MAS

8 October 2024 - Our first total loss vehicle claim handled by the new in-house assessor team, was completed in just over 4 hours as opposed to several days when it went through a third-party assessor.

Investment market commentary - 30 September 2024

21 October 2024 - The market delivered strong investment returns in September with the S&P 500 hitting record highs during the month. This came as a relief, as September is often one of the worst months for investment returns.