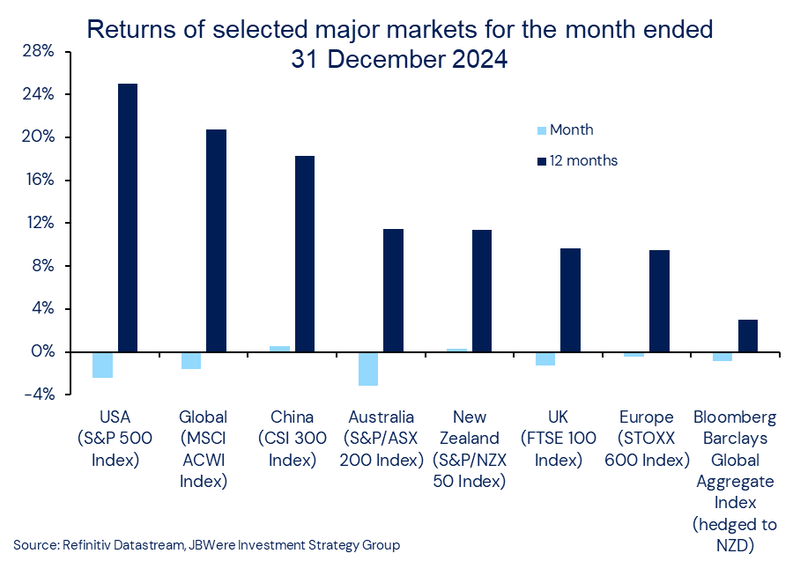

Investors experienced a fantastic 2024 as global share markets1 gained 20.7% (all returns are in local currency terms unless stated) for the 2024 calendar year, which followed a 22.2% gain over 2023. Falling inflation and central bank interest rates, the ongoing excitement around artificial intelligence (AI), Donald Trump winning the race to the White House and robust US economic data, all helped propel global share markets higher.

Heavily exposed to the surging AI trend, the US share market2 led global markets with a 25% gain over the year, experiencing 57 new all-time closing highs. The yearly return marked the second straight annual gain of over 20%, capping off the best 2-year period in 25 years. Over the month of December, the US share market fluctuated, ultimately finishing down 2.4%. While profit-taking after a strong November likely played a part, investors became concerned as the US Federal Reserve hinted that 2025 may hold fewer interest rate cuts than previously signalled, which also saw US bond yields rise (bond prices move in the opposite direction to yields). Given the rising yields, US bonds recorded a negative return in December.

In Europe, the share market3 return was comparatively modest, but still healthy, ending up 9.5% over the year. The European Central Bank lowered interest rates by 0.25% in December, which was less than the market was hoping for. A “more cautious” central bank and political instability contributed to European shares taking a breather in December, falling 0.5%. Credit rating agency, Moody’s, unexpectedly downgraded French government bonds following the collapse of Barner’s government. Disappointingly for investors, the Bank of England kept interest rates unchanged in December as CPI inflation increased to 2.6%. The UK share market4 lost 1.3% over December. Despite this slight pull back in December, the UK share market recorded a healthy gain over 2024 of 9.7%, its best annual return since 2021.

The domestic share market5 bucked the trend, gaining 0.3% over December, which capped off a solid 11.4% gain for the year. Returns were helped by a favourable combination of reducing interest rates, improved corporate confidence, and inflation returning to the RBNZ’s target range of 1–3% for the first time since 2021. Bonds6 also posted positive returns, up 0.6% for the month. Economic data showed the NZ economy has experienced a deeper slowdown over the past six months than expected, increasing the odds of another sizable interest rate cut at the RBNZ’s first meeting in February.

Across the Tasman, the Australian share market7 ended with a yearly return in line with New Zealand’s share market, but followed global markets lower over December, retreating 3.2%. Over the year, sector returns were mixed in Australia, with energy and materials declining by 14%, while technology rose 50%.

The differing fortunes of various market indices are illustrated in the chart below.

Note: Returns are in local currency terms.

Key points to note in the chart above

- Strong returns across share markets over 2024.

- Most major share markets world ended lower over December.

- The share markets in China and here in New Zealand produced relatively good returns over December.

What this means for our funds over the December quarter

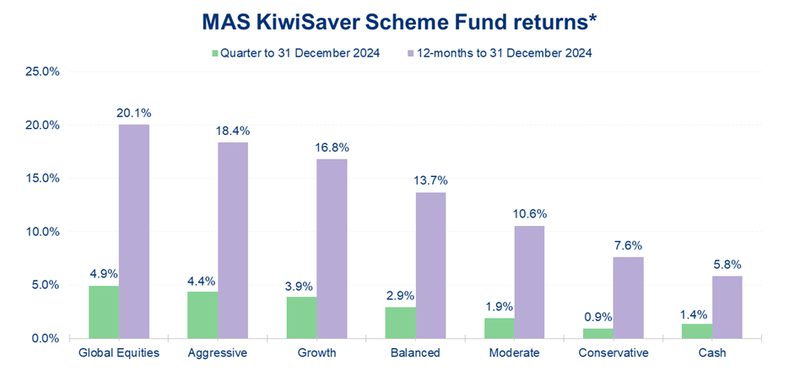

The chart below shows selected returns for all funds in the MAS KiwiSaver Scheme. Returns for comparable funds in the MAS Retirement Savings Scheme and the quarterly returns8 for the comparable funds in the MAS Investment Funds, are very similar.

* Returns are after total annual fund charges and before tax.

Key points to note from the chart above

- The December quarter produced solid fund returns, capping off a remarkable year of performance.

- Growth assets (shares) have outperformed income assets (bonds) over all periods shown in the chart, which has led to the more growth orientated funds outperforming the more conservative funds over these time periods

The outlook

With 2025 underway, we believe there is cause for optimism. The inflation and interest rate shocks of the past few years are largely behind us, central banks are becoming friendlier, US economic resilience should continue, green shoots are emerging in the New Zealand economy, and technological innovation continues at pace. This decent starting point is important, as it suggests the potential for another reasonable year for overall portfolio returns. However, it also provides a little more confidence for investors that financial markets can withstand some surprises or shocks along the way, and 2025 is expected to have a few of those.

Top of the list of big uncertainties, is the direction of foreign trade under the new US government. President Trump has made it very clear that tariffs will again be a feature of his second term in power. We have been here before of course, and what we learned is that there will be winners and losers. This dynamic is perhaps one of the key themes we are expecting to see this year, with greater dispersion in performance across different companies, industries and countries, which will create some interesting opportunities for investors.

As well as risks to international trade, some share markets are highly valued, making them vulnerable if expectations are not met. Government fiscal positions are strained, and geopolitical risks persist. But because of the decent macro starting point, we are mindful of these risks, not fearful of them.

We have useful online tools to help you:

- Our Fund Finder can help you see if you're in the right Fund for your circumstances.

- Our KiwiSaver Retirement Calculator can help you understand if your retirement savings are on track.

- Our MAS Investor Portal can help you manage your investments online.

If you decide to change your Fund after reviewing your risk profile or meeting with a MAS Adviser, you can make a switch via the MAS Investor Portal, or alternatively you can complete an investment strategy change request form. There is no fee for switching. Links to the relevant forms are below.

- MAS KiwiSaver Scheme: KiwiSaver Documents and Forms – MAS

- MAS Retirement Savings Scheme: Retirement Savings Scheme Documents and Forms – MAS

- MAS Investment Funds: Investment Funds Documentations and Forms

You can see weekly updates on fund unit prices and returns on our website:

- MAS KiwiSaver Scheme: KiwiSaver Funds – MAS

- MAS Retirement Savings Scheme: Retirement Savings Scheme Funds | MAS – MAS

- MAS Investment Funds: Investment Funds – MAS

1As represented by the MSCI All Country World index

2As represented by the S&P 500 index

3As represented by the Euro Stoxx 600 index

4As represented by the FSTE 100 index

5As represented by the S&P/NZX 50 index

6As represented by the Bloomberg NZ Bond Composite 0+

7As represented by the S&P/ASX 200 index

8MAS Investment Funds have an inception date February 2024.

This article is of a general nature and is not a substitute for professional and individually tailored advice. Medical Funds Management Limited, JBWere (NZ) Pty Ltd and Nikko Asset Management New Zealand Limited, their parent companies and associated entities do not guarantee the return of capital or the performance of investment funds. Returns indicated may bear no relation to future performance. The value of investments will fluctuate as the values of underlying assets rise or fall.

MAS is a financial advice provider. Our financial advice disclosure statement is available by visiting mas.co.nz or by calling 0800 800 627.

The Product Disclosure Statement for the MAS KiwiSaver Scheme is available: KiwiSaver – MAS

The Product Disclosure Statement for the MAS Retirement Savings Scheme is available: Retirement Savings Scheme – MAS

The Product Disclosure Statement for the MAS Investment Funds is available: Investment Funds – MAS

Medical Funds Management Limited is the issuer and manager of the Schemes.

More news

MAS voted Consumer People's Choice

05 February 2025 - MAS has been voted Consumer People's Choice by our Members 9 years in a row for House, Contents and Car insurance.

Investment market commentary – 31 January 2025

12 February 2025 - Global share markets finished January 3.3% higher despite some market jitters including Trump’s talk of tariffs and privately owned Chinese technology company developing an AI at a fraction of the cost of large US companies.