Global share markets regained their positive momentum over May, recovering last month’s drop and adding a bit more on top. Recent renewed inflation and interest rate worries appeared to dissipate, providing impetus for investors who used lower share prices in April as a buying opportunity. A positive return in May now means that global share markets have gained in 4 of the 5 months this year.

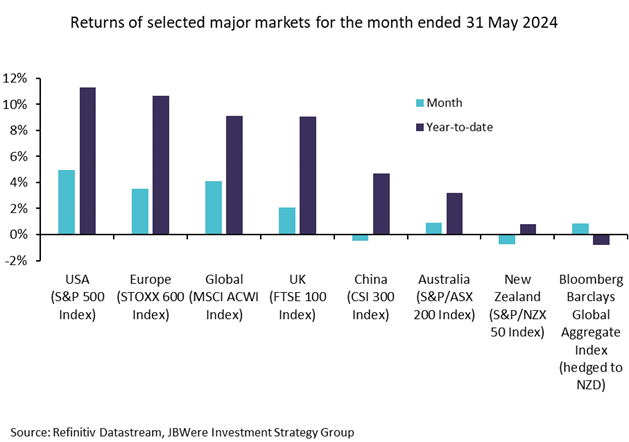

The all-important US share market, as measured by the S&P 500 Index, hit fresh new highs, posting a return of 5% for the month (in USD terms). This now means the US share market is up 11.3% since the start of this year, and 28.2% over the last 12-months. As well as ongoing resilience shown by the US economy, this strong rally has been led by optimism surrounding artificial intelligence related technologies, with the information technology sector gaining a strong 10.1% over the month of May. The strong US market helped push the global market up 4.1% over the month (in local currency terms).

Other share markets around the world, while still positive, fell short of the impressive gains registered in the US. The share market in Europe (Euro Stoxx 600) recorded a 3.5% gain over May. Investors looked through a rise in inflation (the first time in 5 months) and focused on signs of improved economic momentum and expected interest rate cuts at the European Central Bank’s meeting on 6 June. Meanwhile, shares in the UK were a little more subdued, with the FTSE 100 finishing 2.1% higher. The Australian share market (S&P/ASX 200), while finishing up over the month, lagged other global share markets, returning 0.9%.

While most share markets experienced positive returns over May, it was not all plain sailing for investors, with the domestic NZ share market experiencing a small fall. The Reserve Bank of New Zealand (RBNZ) did little to help the local share market at its monetary policy meeting during May. Ahead of the meeting, the market was unsure how the RBNZ would weigh cooling domestic economic data, with stubbornly high inflation. Unfortunately, the answer was not welcomed by local investors and mortgage holders alike, as the RBNZ warned that interest rates may need to stay higher for longer. The RBNZ pushed out its projections for its first cut to the Official Cash Rate (OCR) to August 2025, a full 3 to 4 months later than its forecast in February. And while it left the OCR unchanged at 5.5%, there was a discussion at the meeting about the possibility of lifting interest rates further. Despite a strong finish over the last 2 days of May, the local share market ended the month down -0.8%.

Returns in fixed interest investments over May were mixed as inflationary pressures and the timing of potential central bank interest rate cuts continue to diverge in countries around the world. Bonds in the US, Australian and New Zealand largely provided positive returns, while returns across Europe were mixed, but primarily negative. Fully NZD hedged international bonds gained 0.9% over the period.

The quick recovery in global share markets following April’s downturn, is a good reminder that markets can shift rapidly, and focusing on long-term investment goals is the key to retirement savings. Selling investments based on short-term market fluctuations could limit the potential of your savings nest egg.

Note: Returns are in local currency terms.

The outlook

Global equity market performance remains at the whims of competing forces. On one hand, markets are benefiting from a generally favourable US economic backdrop (resilient economic activity, easing inflation and a peak in central bank policy rates), and the excitement surrounding new technologies (artificial intelligence especially). On the other hand, investor expectations have risen, and valuations are elevated, increasing the risk of disappointment. If this favourable economic picture persists, and companies continue to deliver on (increased) expectations, which is conceivable, these high valuations are not an immediate area of concern. However, at this time when risks remain to the economic outlook from the likes of geopolitics, and questions remain over how quickly and easily inflation will sustainably return to central bank targets (noting a few hiccups in some economies recently), we believe it is prudent to hold a modestly cautious view towards the economic and markets outlook overall. This modestly cautious stance is something we continue to maintain for the funds in each of the MAS Schemes.

We have useful online tools to help you:

- Our Fund Finder can help you see if you're in the right fund for your circumstances.

- Our KiwiSaver Retirement Calculator can help you understand if your retirement savings are on track.

- Our MAS Investor Portal can help you manage your investments online.

If you decide to change your fund after reviewing your risk profile or meeting with a MAS Adviser, you will need to complete an investment strategy change request form or for MAS Investment Funds investors, switch via the MAS Investor Portal:

- MAS KiwiSaver Scheme: KiwiSaver Documents and Forms – MAS

- MAS Retirement Savings Scheme: Retirement Savings Scheme Documents and Forms – MAS

- MAS Investment Funds: Investment Funds Documentations and Forms

There is no fee for switching.

You can see weekly updates on fund unit prices and returns on our website:

- MAS KiwiSaver Scheme: KiwiSaver Funds – MAS

- MAS Retirement Savings Scheme: Retirement Savings Scheme Funds | MAS – MAS

- MAS Investment Funds: Investment Funds – MAS

This article is of a general nature and is not a substitute for professional and individually tailored advice. Medical Funds Management Limited, JBWere (NZ) Pty Ltd and Bancorp Treasury Services Limited, their parent companies and associated entities do not guarantee the return of capital or the performance of investment funds. Returns indicated may bear no relation to future performance. The value of investments will fluctuate as the values of underlying assets rise or fall.

MAS only provides advice on products offered by its subsidiary companies. Advice is provided by MAS or by its nominated representatives (who are all MAS employees). Our financial advice disclosure statement is available by visiting mas.co.nz or by calling 0800 800 627.

The Product Disclosure Statement for the MAS KiwiSaver Scheme is available: KiwiSaver – MAS

The Product Disclosure Statement for the MAS Retirement Savings Scheme is available: Retirement Savings Scheme – MAS

The Product Disclosure Statement for the MAS Investment Funds is available: Investment Funds – MAS

Medical Funds Management Limited is the issuer and manager of the Schemes.

More news

Lots of fun was had at the MAS Movie Night

25 June 2024 - After a 5-year hiatus, we were delighted to bring back the MAS Movie night on Thursday 20 May.

Natural Hazards Insurance Act 2023 updates

1 July 2024 - There is a new governing legislation, the Natural Hazards Insurance Act 2023 (NHI Act). This Act modernises and replaces the Earthquake Commission Act 1993 (EQC Act).