Before discussing events that influenced markets during July, we thought it important to touch on market events over the past week. It appears the tipping point to the recent drop in global share markets was a larger than expected slowdown in US job growth and rising unemployment. This increased investor concern that the US economy may be heading for a recession and that the US Federal Reserve may have left it too long before cutting interest rates. This, coupled with modestly disappointing earnings results (relative to very high expectations) of large US technology companies, has seen investor sentiment sour.

The Japanese share market has been the main outlet for investor anxiety, in part due to technical factors relating to market positioning and excessive leverage. Together with the global concerns of a potential US recession, investors were also surprised by the recent action of Japan’s central bank. The Bank of Japan raised interest rates last week at a time when global peers are doing the opposite. This led to a strengthening Japanese yen, which reduces the earnings outlook for Japan’s export-oriented companies. This contributed to significant volatility in the Japanese share market over the last few days.

Regular readers of our market commentaries will know our cautious positioning within the MAS Schemes, which has seen the MAS Schemes maintain an underweight global equities allocation (relative to the target weight). This stance has cushioned some of the losses experienced in share markets over the past week.

Volatility can be is unsettling and is likely to remain a feature of the market in the near-term. However, the recent volatility does not appear to be caused by a long-term fundamental shift. In times like this, it’s important to remember that investing is for the long-term. During a challenging period, it’s important to keep the long-term in mind and see past any shorter-term peaks and troughs. It’s reassuring to know that you can speak face-to-face to your dedicated MAS Adviser who will work with you to ensure your investment settings meet your needs and help you stick to it during challenging times.

Now, back to July…

Share markets around the world were hit by a cacophony of political, economic and company specific headlines. Volatility in share markets increased as the market leadership shifted from large cap stocks to small cap names. After a rollercoaster ride, global equities as measured by the MSCI All Country World Index (all returns are in local currency terms unless stated), returned 1.6% over July.

As all eyes turned to the athletes at the Paris Summer Olympics, it was events across the Atlantic Ocean that drew investors’ attention. As is often the case, every 4 years the US presidential election brings its own drama. This US election campaign appears to have ramped it up a notch, impacting financial markets. Joe Biden’s below par performance during the first presidential debate with Donald Trump, placed the former president firmly in pole position for re-election. This position became even stronger after the failed assassination attempt on former President Trump at his Pennsylvania rally. This saw the ‘Trump trade’, which refers to stocks and industries expected to benefit from Trump’s policies, take full effect. However, later in the month, news that Kamala Harris will replace Joe Biden as the Democratic nominee saw a shift in the polls. This stabilised financial markets as the possibility of the Senate and House of Representatives being divided came back into play.

Trump’s policies such as stricter immigration, higher tariffs, lower taxes and increased spending, which are generally viewed as inflationary, had a major impact on the financial markets over the month. Trump’s position on higher tariffs was likely a key driver of the rotation out of large cap stocks that have powered the stock market this year, into small cap names. Increased tariffs on US imports would likely benefit companies that conduct business within the US, as opposed to larger global companies. To illustrate the market leadership change, over July the S&P SmallCap 600 Index gained +10.8%, compared to the S&P 500 Index (dominated by large cap names) which delivered +1.2%. The technology sector has become dominated by large cap names, and this rotation towards small caps saw technology as one of the few sectors to produce a negative return over July. The shift away from large cap technology names wasn’t isolated to the US - other share markets around the world also experienced a decline in this sector.

The swing towards small cap companies wasn’t all down to the ‘Trump trade’. The current economic environment with its lower inflationary pressures is also helping. Small cap companies, which are more reliant on capital markets and floating rate borrowing for financing, are more likely to benefit from falling interest rates compared to their larger counterparts.

Bond yields around the world ultimately ended lower (yields move in the opposite direction to price) as investors placed more weight to promising inflation and manufacturing data over Trump’s potential inflationary policies. The yield on the US 10-year Treasury bond ended the month at 4.03%, while the German equivalent finished at 2.30%. Bond yields have continued to drop in the market volatility at the start of August.

Reporting season is well and truly underway in the US; however, it was a US cybersecurity firm, CrowdStrike, making headlines for all the wrong reasons. CrowdStrike’s software update caused a major worldwide IT outage, leaving airports in chaos and closing supermarkets. CrowdStrike’s share price has tumbled since the outage and fell 40% over the month.

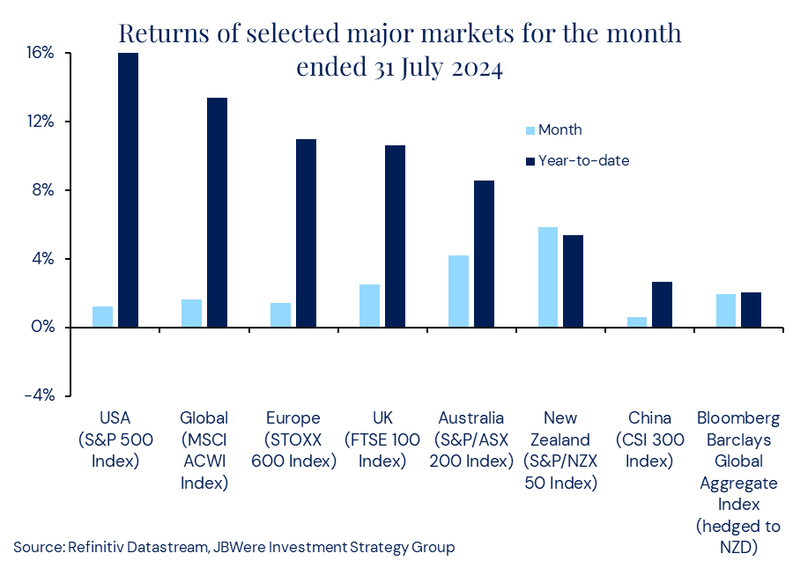

Closer to home, domestic equities and bonds advanced, boosted by softening inflation and expectations of interest rate cuts. Both the Australian and New Zealand share markets recorded their best month of the year, with the S&P/ASX 200 Index gaining +4.2% while the S&P/NZX 50 Index finished up +5.9%. During the month the S&P/ASX 200 Index hit an all-time record high, poking its head above the 8,000 level for the first time in its history.

The differing fortunes of various asset classes are illustrated in the chart below.

Note: Returns are in local currency terms.

The outlook

Over the past couple of years, the 2 defining features of the global economic and financial market landscape has been the outperformance of the US economy and the strong returns delivered by the world’s largest technology companies. Our lead investment manager JBWere sees both now being at interesting junctures. Firstly, the US economy is finally cooling. It is quite plausible that it avoids a more dramatic slowdown (i.e. recession), which is a clear risk if the labour market deteriorates sharply. This would then call into question the expectations for future corporate earnings that have been built into current share prices. There has been a few more questions emerging recently regarding the expectations for large technology companies. This includes how quickly they will be able to monetise the large amount of capital expenditure they’ve spent on new exciting technologies like artificial intelligence.

We are always looking for catalysts to turn more constructive on equity markets. However, with the turbulent geopolitical landscape, a key US election only months away, and uncertainty as to where interest rates will settle over the long run, we believe it is prudent to maintain a conservative view towards the outlook for investment markets. Our preference for the MAS Schemes is for quality investments that should be better placed given the uncertain backdrop. That said, we continue to seek and take advantage of opportunities when they present themselves, whether it is in fixed interest markets and capturing the relatively high yields still on offer, or in equities where relative sentiment is beginning to shift more positively (like in the New Zealand market for example).

We have useful online tools to help you:

- Our Fund Finder can help you see if you're in the right Fund for your circumstances.

- Our KiwiSaver Retirement Calculator can help you understand if your retirement savings are on track.

- Our MAS Investor Portal can help you manage your investments online.

If you decide to change your Fund after reviewing your risk profile or meeting with a MAS Adviser, you can make a switch via the MAS Investor Portal, or alternatively you can complete an investment strategy change request form. There is no fee for switching. Links to the relevant forms are below.

- MAS KiwiSaver Scheme: KiwiSaver Documents and Forms – MAS

- MAS Retirement Savings Scheme: Retirement Savings Scheme Documents and Forms – MAS

- MAS Investment Funds: Investment Funds Documentations and Forms

You can see weekly updates on fund unit prices and returns on our website:

- MAS KiwiSaver Scheme: KiwiSaver Funds – MAS

- MAS Retirement Savings Scheme: Retirement Savings Scheme Funds | MAS – MAS

- MAS Investment Funds: Investment Funds – MAS

This article is of a general nature and is not a substitute for professional and individually tailored advice. Medical Funds Management Limited, JBWere (NZ) Pty Ltd and Nikko Asset Management New Zealand Limited, their parent companies and associated entities do not guarantee the return of capital or the performance of investment funds. Returns indicated may bear no relation to future performance. The value of investments will fluctuate as the values of underlying assets rise or fall.

MAS is a financial advice provider. Our financial advice disclosure statement is available by visiting mas.co.nz or by calling 0800 800 627.

The Product Disclosure Statement for the MAS KiwiSaver Scheme is available: KiwiSaver – MAS

The Product Disclosure Statement for the MAS Retirement Savings Scheme is available: Retirement Savings Scheme – MAS

The Product Disclosure Statement for the MAS Investment Funds is available: Investment Funds – MAS

Medical Funds Management Limited is the issuer and manager of the Schemes.

More news

Report on the MAS 2024 Annual General Meeting on 21 August 2024

22 August 2024 - For the first time in 5 years, the MAS Annual General Meeting was held in-person at the Cordis Hotel in Auckland and online. We thank all those Members who attended the meeting and who cast votes on the various resolutions.

Investment Market Commentary – month ended 31 August 2024

10 September 2024 - Share markets rebound after short-term jitters. After the initial commotion at the start of August, it was relatively plain sailing for the rest of the month, with share markets around the world steadily recovering.