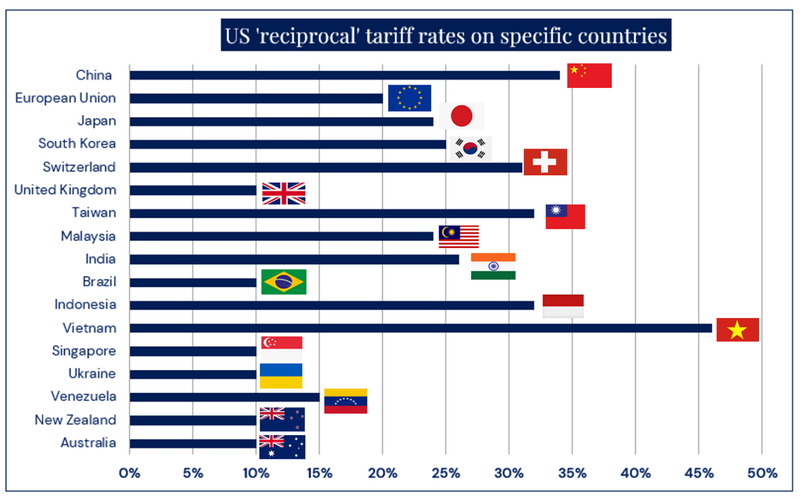

On Thursday 3 April 2025 (NZ time), the Trump administration announced its long-awaited tariff policy. The magnitude and scope of the tariffs were significantly more aggressive than expected. They cover more than 180 countries and territories, including New Zealand.

It’s a two-part tariff plan, with New Zealand and Australia caught in the universal 10% tariff on all imports into the US, taking effect from 5 April. The second part captures around 60 countries, which will face higher tariffs from 9 April, including 34% (which is on top of the 20% already delivered) on China.

If tariffs stay at these levels, global growth is likely to decline, and inflationary pressures rise as businesses respond. While the US tariff policy has been announced, uncertainty remains. President Trump has said he is open to negotiations, and all eyes are now on policy makers around the world and how they will respond.

Source: JBWere (NZ) Pty Ltd.

With such an aggressive stance, it was not surprising to see share markets around the world decline following the announcement. Investors sought the relative safety of bonds, pushing bond yields lower and prices higher. The day after the US announcement, China hit back with its own tariffs on US goods. Concerns increased that the US tariff policy might spark a global trade war. Over the two trading days following the US tariff announcement, European markets were down 8.0%1 (all returns are in local currency unless stated), the UK market fell 6.4%2, and the US share market ended 10.5%3 lower. In comparison, the domestic share market has held up relatively well.

This is a very unusual shock. Typical downturns resulting from unwinding economic imbalances, such as inflation or financial excesses, tend to last longer. This episode is clearly different. As uncomfortable as it may feel, JBWere (our lead investment manager) believes the best approach is to not overreact. Yes, there are scenarios where further market downside may play out, however, the risks are being priced rapidly. Equally, there are scenarios where markets might get some reprieve, and they begin to price less negative news, such as the prospect of watered down tariff levels.

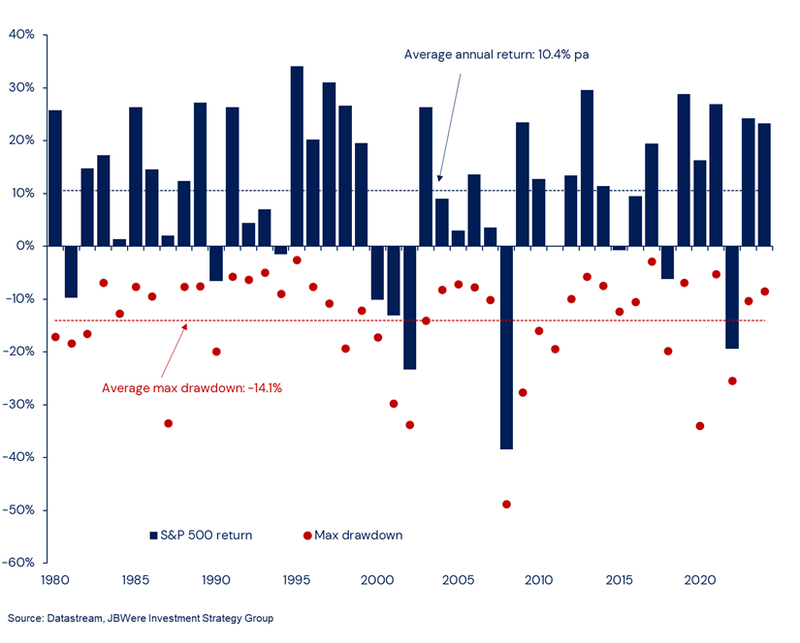

While the tariff news caused an extreme sell off, what we’d like to emphasise and remind investors is that market volatility is a natural part of investing. Market corrections are normal and large intra-year moves are not uncommon, even in years when positive annual returns are achieved as seen in the chart below. While the US share market has been the focal point for souring investor sentiment, other share markets around the world, such as the New Zealand share market, and other asset classes (such as bonds), have held up better. This is why MAS believes an actively managed fund, which is highly diversified, is the best long-term investment approach.

To help navigate volatility, it is important for investors to maintain their focus on the long-term investment horizon. Markets can shift rapidly, and selling investments based on short-term market fluctuations could limit the potential of your savings nest egg.

S&P 500 Returns & Annual Maximum Drawdowns4

We know that volatility in markets can be unsettling. If you would like to consider your investment options, the Fund Finder tool on our website and our nationwide network of MAS Advisers, are here to help.

We have useful online tools to help you:

- Our Fund Finder can help you see if you're in the right Fund for your circumstances.

- Our KiwiSaver Retirement Calculator can help you understand if your retirement savings are on track.

- Our MAS Investor Portal can help you manage your investments online.

If you decide to change your Fund after reviewing your risk profile or meeting with a MAS Adviser, you can make a switch via the MAS Investor Portal, or alternatively you can complete an investment strategy change request form. There is no fee for switching. Links to the relevant forms are below.

- MAS KiwiSaver Scheme: KiwiSaver Documents and Forms – MAS

- MAS Retirement Savings Scheme: Retirement Savings Scheme Documents and Forms – MAS

- MAS Investment Funds: Investment Funds Documentations and Forms

You can see weekly updates on fund unit prices and returns on our website.

1 Euro Stoxx 50 Index

2 UK FTSE 100 Index

3 S&P 500 Index

4 Annual Maximum Drawdown has been measured as the largest intra-year peak-to-trough fall in the S&P 500 Index within that calendar year

This article is of a general nature and is not a substitute for professional and individually tailored advice. Medical Funds Management Limited, JBWere (NZ) Pty Ltd and Nikko Asset Management New Zealand Limited, their parent companies and associated entities do not guarantee the return of capital or the performance of investment funds. Returns indicated may bear no relation to future performance. The value of investments will fluctuate as the values of underlying assets rise or fall.

MAS is a financial advice provider. Our financial advice disclosure statement is available by visiting mas.co.nz or by calling 0800 800 627.

The Product Disclosure Statement for the MAS KiwiSaver Scheme is available: KiwiSaver – MAS

The Product Disclosure Statement for the MAS Retirement Savings Scheme is available: Retirement Savings Scheme – MAS

The Product Disclosure Statement for the MAS Investment Funds is available: Investment Funds – MAS

Medical Funds Management Limited is the issuer and manager of the Schemes.

More news

Global financial market volatility update

14 April 2025 - Phil Borkin, Senior Investment Strategist at JBWere, lead investment manager for the MAS Schemes, discusses what’s causing this volatility and the potential economic impacts in a video.

Supporting Members on their governance journey

16 April 2025 - The MAS Board has approved the launch of a new governance programme exclusively for MAS Members that are doctors, dentists and veterinarians.