Volatility in global share markets has increased recently, as the tariff trade war and some softer US economic data hits investor sentiment. The US share market1 has been the main outlet for investor anxiety, wiping out the strong gains made at the start of the year. The question is whether this weakness is just a correction or the start of a more sustained market downturn?

It would be remiss of us not to say that risks have increased. However, our lead investment manager, JBWere NZ, doesn’t believe that we have entered a sustained market downturn. Such downturns are usually due to meaningful economic and earnings slowdowns, and this is not what we are currently observing.

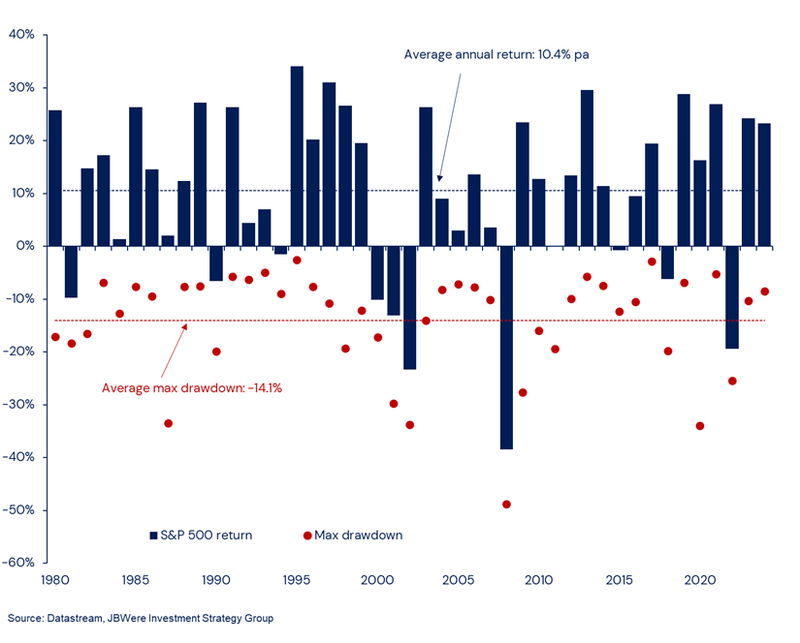

What we’d like to emphasise and remind investors is that market volatility is a natural part of investing. Market corrections are normal and large intra-year moves are not uncommon, even in years when positive annual returns are achieved as seen in the chart below. While the US share market has been the focal point for souring investor sentiment, other share markets around the world, such as European markets, have held up better. This is why MAS believes an actively managed fund, which is highly diversified, is the best long-term investment approach.

To help navigate volatility, it is important for investors to maintain their focus on the long-term investment horizon. Markets can shift rapidly, and selling investments based on short-term market fluctuations could limit the potential of your savings nest egg.

S&P 500 Returns & Annual Maximum Drawdowns2

We have useful online tools to help you:

- Our Fund Finder can help you see if you're in the right Fund for your circumstances.

- Our KiwiSaver Retirement Calculator can help you understand if your retirement savings are on track.

- Our MAS Investor Portal can help you manage your investments online.

If you decide to change your Fund after reviewing your risk profile or meeting with a MAS Adviser, you can make a switch via the MAS Investor Portal, or alternatively you can complete an investment strategy change request form. There is no fee for switching. Links to the relevant forms are below.

- MAS KiwiSaver Scheme: KiwiSaver Documents and Forms – MAS

- MAS Retirement Savings Scheme: Retirement Savings Scheme Documents and Forms – MAS

- MAS Investment Funds: Investment Funds Documentations and Forms

You can see weekly updates on fund unit prices and returns on our website:

- MAS KiwiSaver Scheme: KiwiSaver Funds – MAS

- MAS Retirement Savings Scheme: Retirement Savings Scheme Funds | MAS – MAS

- MAS Investment Funds: Investment Funds – MAS

1 As represented by the S&P 500 Index.

2 Annual Maximum Drawdown has been measured as the largest intra-year peak-to-trough fall in the S&P 500 Index within that calendar year.

This article is of a general nature and is not a substitute for professional and individually tailored advice. Medical Funds Management Limited, JBWere (NZ) Pty Ltd and Nikko Asset Management New Zealand Limited, their parent companies and associated entities do not guarantee the return of capital or the performance of investment funds. Returns indicated may bear no relation to future performance. The value of investments will fluctuate as the values of underlying assets rise or fall.

MAS is a financial advice provider. Our financial advice disclosure statement is available by visiting mas.co.nz or by calling 0800 800 627.

The Product Disclosure Statement for the MAS KiwiSaver Scheme is available: KiwiSaver – MAS

The Product Disclosure Statement for the MAS Retirement Savings Scheme is available: Retirement Savings Scheme – MAS

The Product Disclosure Statement for the MAS Investment Funds is available: Investment Funds – MAS

Medical Funds Management Limited is the issuer and manager of the Schemes.

More news

Investments: 2 days of tariff turmoil

7 April 2025 - The Trump administration announced its long-awaited tariff policy. The magnitude and scope of the tariffs were significantly more aggressive than expected.

Global financial market volatility update

14 April 2025 - Phil Borkin, Senior Investment Strategist at JBWere, lead investment manager for the MAS Schemes, discusses what’s causing this volatility and the potential economic impacts in a video.