Why choose the MAS KiwiSaver Scheme?

Hands-on investment management

Our active approach to investing aims to outperform the market and deliver higher returns for your KiwiSaver account.

Advice when you need it

Our range of tools and nationwide network of MAS Advisers are here to help you enhance your wealth and create the financial future you want.

100% owned by our members

We're a New Zealand owned mutual that's here for our members, not overseas shareholders. When you join us, you become one of our owners.

We have a diverse range of 7 funds to choose from

Growth Fund

Suitable for investors who are prepared to accept a higher level of investment risk to potentially achieve a higher return over the long term.

Balanced Fund

Suitable for investors who are prepared to accept a medium level of investment risk to potentially achieve a medium return over the medium term.

Conservative Fund

Suitable for investors willing to accept a smaller amount of investment risk to potentially achieve a more stable return over the short term.

We aim to outperform

The long-term performance of your investment funds makes a big difference to growing your savings, which is why we take an active investment approach.

Invest in the future you want

Whether you’re saving for your first home or retirement, we can help you get there by investing your money actively and responsibly.

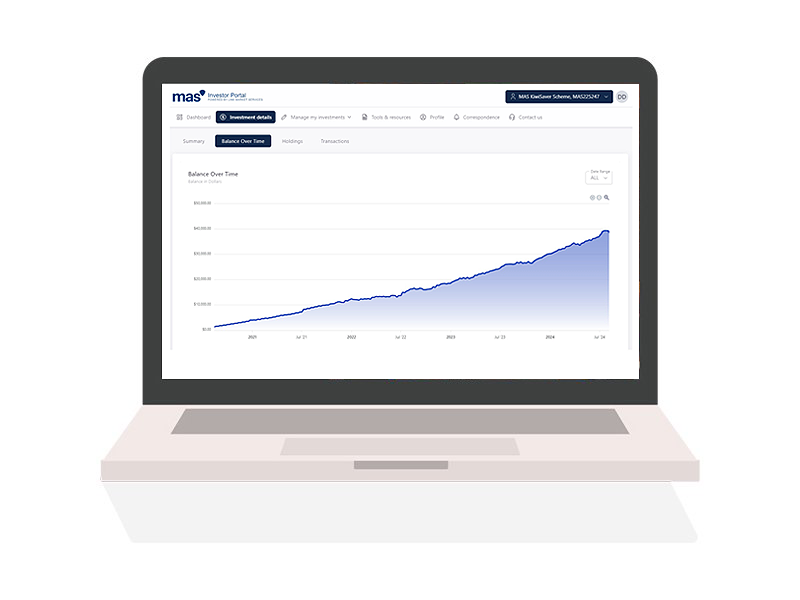

Easy account management

It’s easy to manage your account with our MAS Investment Portal. You can see your balance, switch Funds, update your details and more.

Useful links

You can access the latest Investment Information, including quarterly fund updates which provide a detailed overview of performance fees, asset mix and key holdings for each fund.

Medical Funds Management Limited is the issuer and manager of the MAS KiwiSaver Scheme, MAS Retirement Savings Scheme, and MAS Investment Funds. The Product Disclosure Statements are available at MAS KiwiSaver Scheme PDS, MAS Retirement Savings Scheme PDS, and MAS Investment Funds PDS.

If you would like to talk to a MAS Adviser, phone 0800 800 627 or email info@mas.co.nz.