Choose the right fund for your future

Everyone has different goals and circumstances. That's why the MAS Investment funds offer 7 different funds for you to invest in, so you can find a fund or combine funds to meet your needs. Our Responsible Investment page guides what we will and won’t invest in.

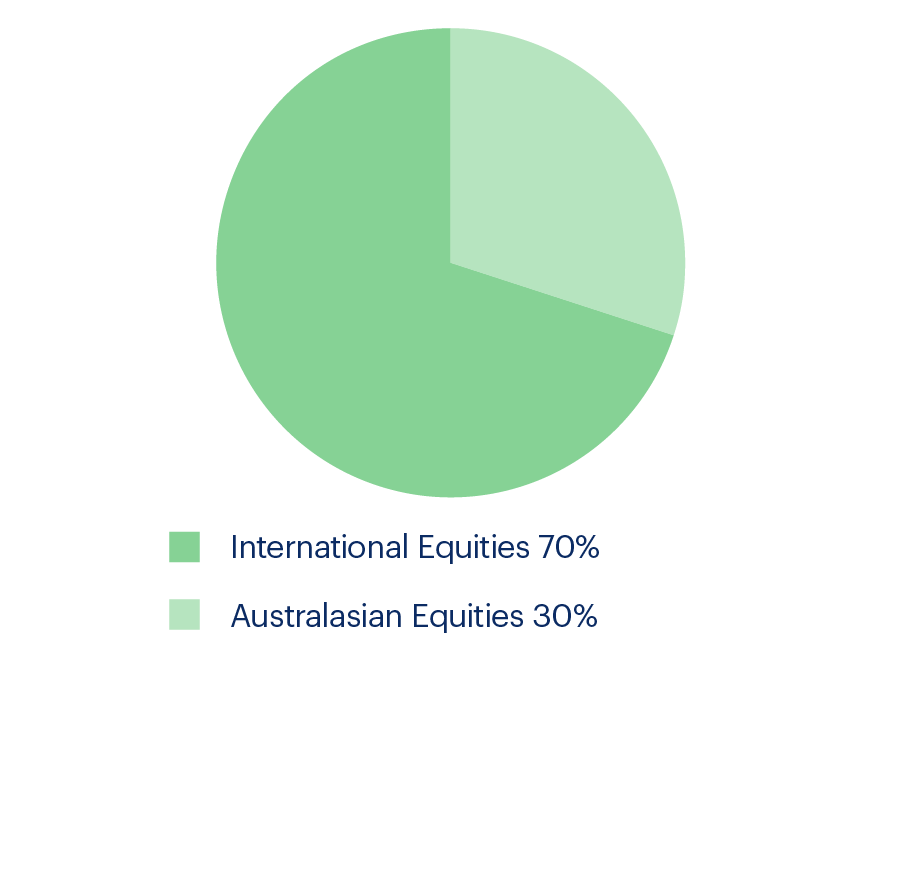

Global Equities Fund

Suitable for investors who are prepared to accept a higher level of investment risk to potentially achieve a higher return.

This Fund aims to provide higher returns over the long term. It usually only invests in growth assets.

Min. suggested investment timeframe: 12 Years

Risk indicator: 5

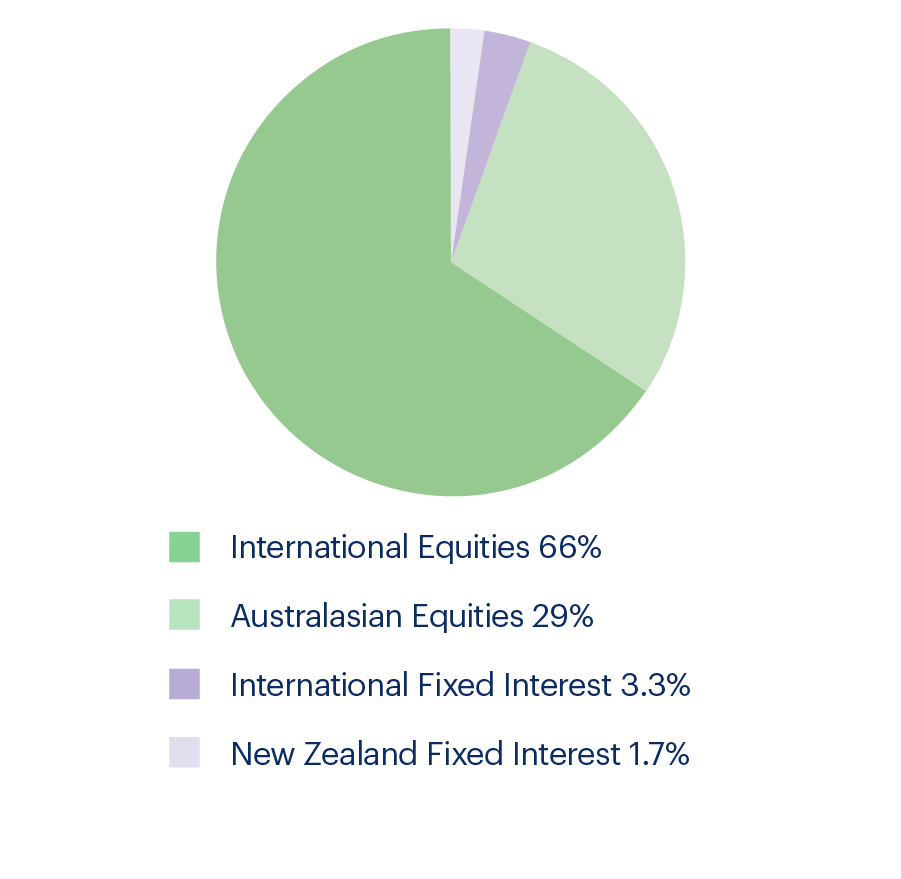

Aggressive Fund

Suitable for investors who are prepared to accept a higher level of investment risk to potentially achieve a higher return.

This Fund aims to provide higher returns over the long term. It invests around 95% in growth assets and around 5% in income assets.

Min. suggested investment timeframe: 11 Years

Risk indicator: 5

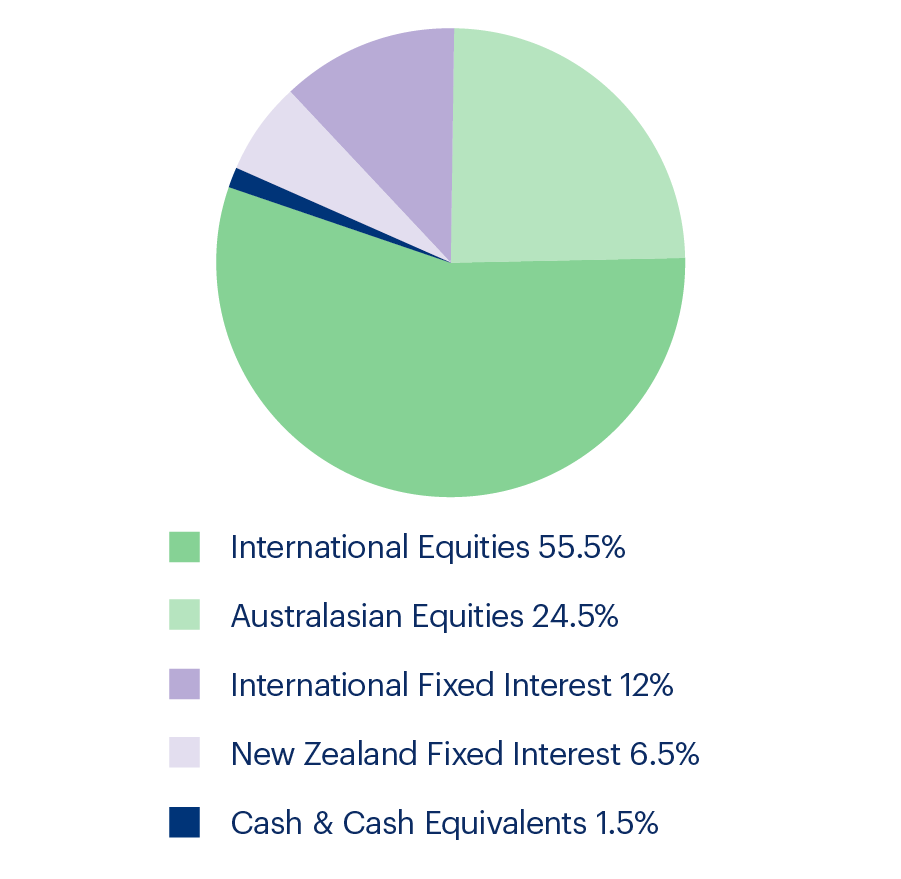

Growth Fund

Suitable for investors who are prepared to accept a high level of investment risk to potentially achieve a high return.

Aims to provide strong returns over the long term. This Fund invests around 80% in growth assets and around 20% in income assets.

Min. suggested investment timeframe: 10 Years

Risk indicator: 4

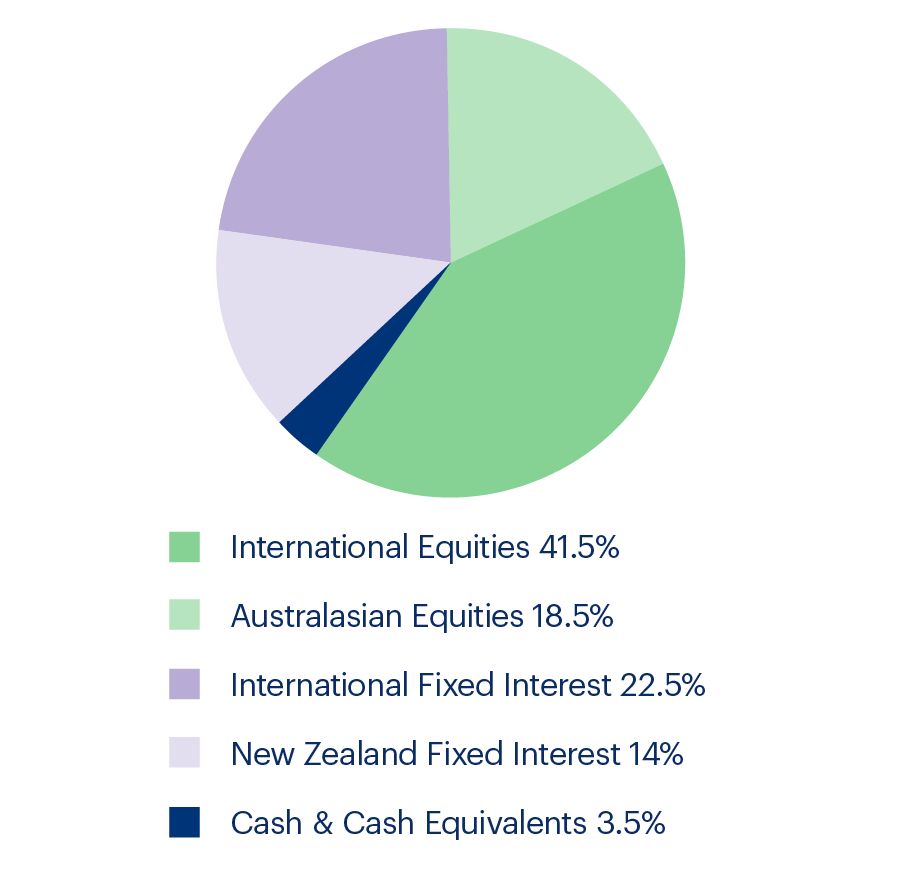

Balanced Fund

Suitable for investors who are prepared to accept a medium level of investment risk to potentially achieve a medium return.

Aims to provide a medium level of return over the medium term by investing in a mix of around 60% in growth assets and 40% in income assets

Min. suggested investment timeframe: 7 Years

Risk indicator: 4

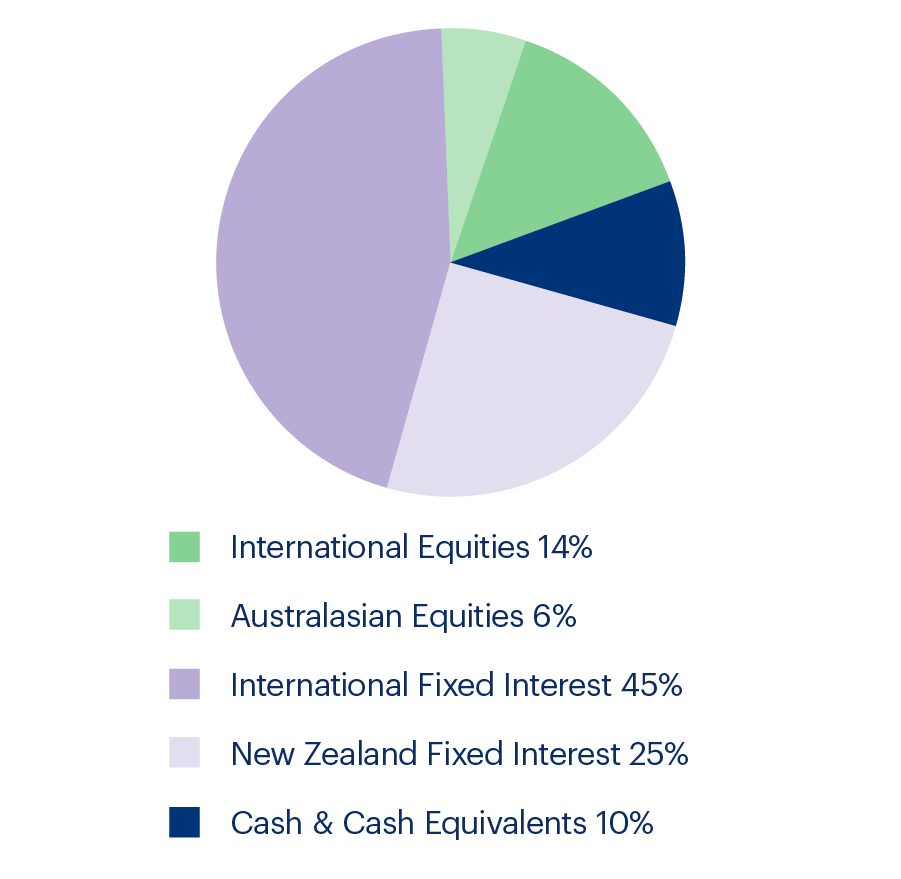

Moderate Fund

Suitable for investors who are prepared to accept some investment risk to potentially achieve a moderate return.

While investing around 60% in income assets and around 40% in growth assets this Fund aims to provide moderate returns over the short to medium term.

Min. suggested investment timeframe: 5 Years

Risk indicator: 4

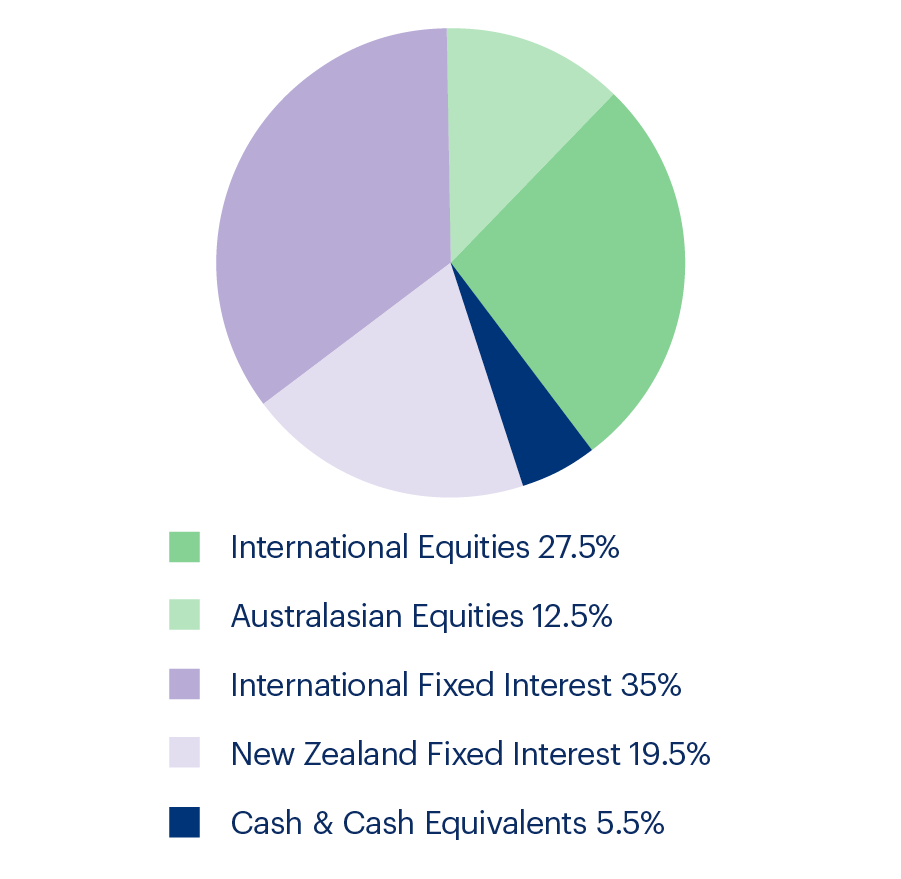

Conservative Fund

Suitable for investors who want to take a more cautious approach and accept a smaller amount of investment risk to potentially achieve a more stable return.

The Fund aims to preserve capital while providing a steady return over the short to medium term by investing around 80% in income assets and around 20% in growth assets.

Min. suggested investment timeframe: 3 Years

Risk indicator: 3

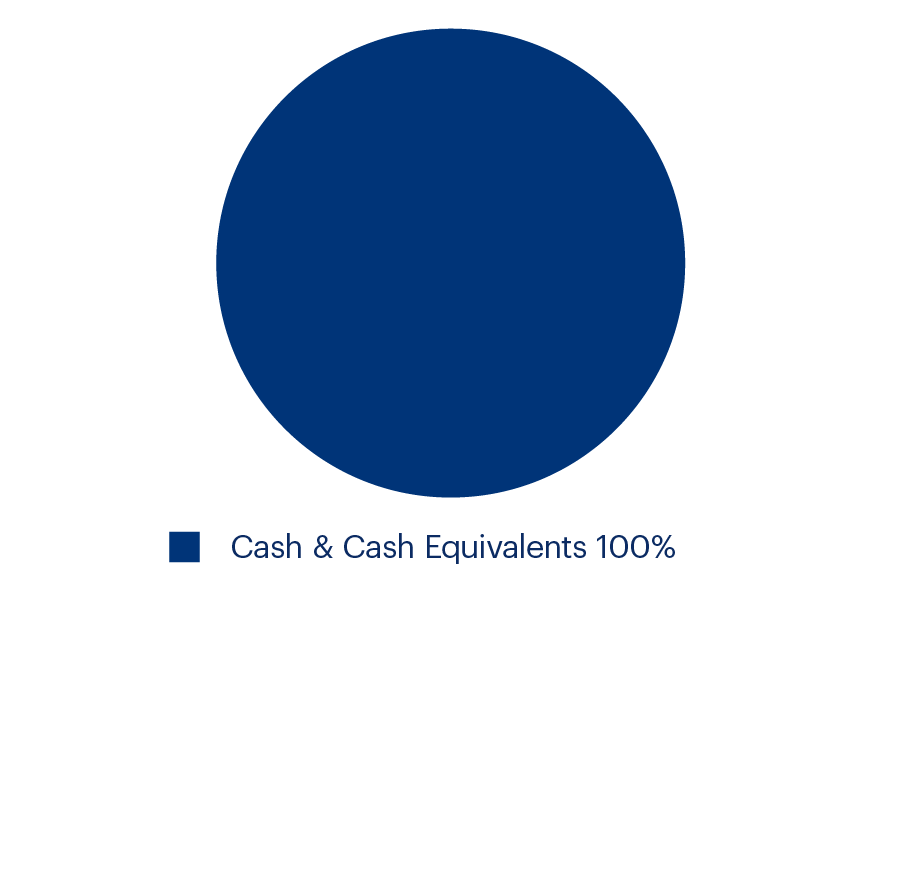

Cash Fund

Suitable for investors who require an investment with very low volatility.

The Fund aims to achieve stable returns over the short term by investing in a range of cash and cash equivalent investments.

Min. suggested investment timeframe: No min.

Risk indicator: 1

MAS Investment Fund Performance

|

Fund |

1 mth |

3 mths |

1 year |

Since Inception |

Unit Price |

|

Global Equities |

2.50% | 7.89% | 14.72% | 28.54% | 1.2856 |

|

Aggressive |

2.39% | 7.52% | 14.04% | 27.08% | 1.2709 |

|

Growth |

2.07% | 6.48% | 12.51% | 24.76% | 1.2483 |

|

Balanced |

1.60% | 4.94% | 9.96% | 20.89% | 1.2111 |

|

Moderate |

1.10% | 3.38% | 7.46% | 16.85% | 1.17 |

|

Conservative |

0.61% | 1.85% | 5.05% | 13.66% | 1.1388 |

|

Cash |

0.34% | 1.03% | 4.88% | 8.67% | 1.088 |

Performance is as of 30 September 2025, after the annual fund charge and before tax. The return since inception is the return since the start date of the fund. Although the first PDS for the Scheme was registered on 31 January 2024, unit pricing for the Funds in the Scheme did not start until 12 February 2024.

Useful links

*Medical Funds Management Limited, JBWere (NZ) Limited and Amova Asset Management New Zealand Limited, their parent companies and associated entities do not guarantee the return of capital or the performance of investment funds. Returns indicated may bear no relation to future performance. The value of investments will fluctuate as the values of underlying assets rise or fall.

Medical Funds Management Limited is the manager and issuer of investments in the MAS Investment Funds. A copy of the Product Disclosure Statement (PDS) for the Scheme is available here.

You can access the latest Investment Information which provide a detailed overview of performance, fees, asset mix and key holdings for each fund. If you would like to talk to a MAS Adviser, phone 0800 800 627 or email info@mas.co.nz.