The MAS Retirement Savings Scheme is a Recognised Overseas Pension Scheme (ROPS), which means it can accept money transferred from certain UK pension schemes.

-

One low fee ranging from 0.25% to 0.99% p.a

-

Actively managed investments which aim to outperform the market

-

Choose from a range of 7 different funds

Why choose MAS?

1

Competitive fees

With one transparent fund management fee ranging from 0.25% to 0.99% per annum depending on the fund chosen, our fees are among the lowest in the market. The Scheme does not charge additional fees, including for UK pension transfers.

2

Advice at no additional cost

MAS Advisers are available at no additional cost and can help you select the right fund to achieve your retirement savings goals. You remain responsible for the pension transfer process. Depending on your UK pension provider, you may be required to obtain independent financial or tax advice from a UK qualified adviser.

3

100% owned by our Members

We're a New Zealand-owned mutual that's here for our Members, not overseas shareholders. When you join us, you become one of our owners.

Reasons to consider transferring your UK pension to NZ

Simplify your finances. Consolidating your assets in one country can help you keep track and stay in control of your funds.

Reduce your exchange rate risk. Saving in the currency of the country you live in may help you reduce your exchange rate risk, which could affect your income in retirement.

Different tax treatment. Once transferred to New Zealand, funds can generally be withdrawn tax-free at retirement age. Please note there will be other tax considerations, and it’s recommended that you seek tax advice.

We have a diverse range of 7 funds to choose from

Growth Fund

Suitable for investors who are prepared to accept a higher level of investment risk to potentially achieve a higher return over the long term.

Balanced Fund

Suitable for investors who are prepared to accept a medium level of investment risk to potentially achieve a medium return over the medium term.

Conservative Fund

Suitable for investors willing to accept a smaller amount of investment risk to potentially achieve a more stable return over the short term.

We aim to outperform

The long-term performance of your investment funds makes a big difference to growing your savings, which is why we take an active investment approach.

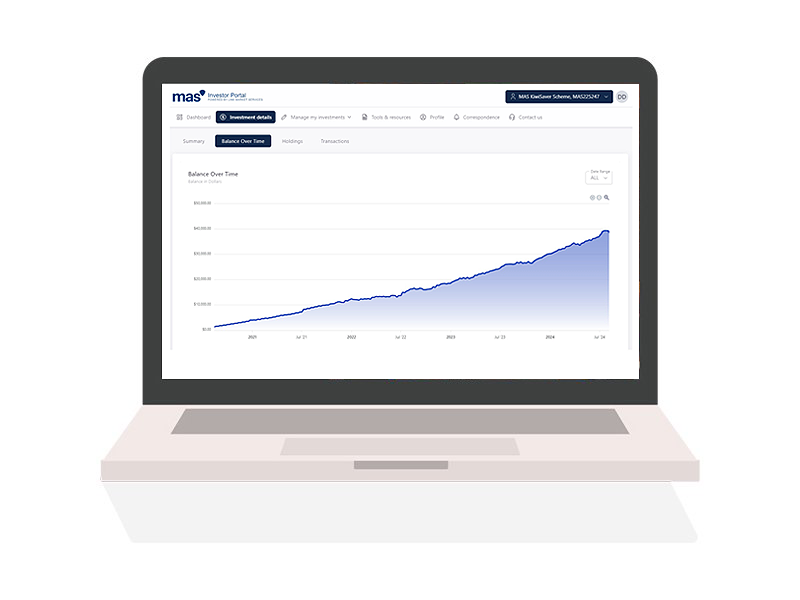

Easy account management

It’s easy to manage your account with our MAS Investor Portal. You can see your balance, switch funds, update your details and more.

Frequently asked questions

Can I transfer my pension?

It is recommended you speak with your UK pension provider to understand if you can transfer your UK pension to New Zealand. Transfers from some UK pension schemes are difficult and others are not permitted under UK law.

When can I access my savings?

Funds transferred from the UK can be accessed from age 55*. If you become seriously ill, you may be able to access your savings sooner. In the event of your death, your balance will go to your estate, with no death duties applied in New Zealand.

*From 6 April 2028, the minimum age at which benefits can be taken will change from 55 to 57, which may affect when you are able to access your savings.

What are the tax implications of transferring my UK pension?

You should seek UK and New Zealand tax advice if you are intending on transferring UK pension funds. Generally, if you transfer your UK pension to a ROPS within 4 years of moving to New Zealand, you typically won’t have to pay New Zealand tax on your lump sum transfer. Once transferred to New Zealand, the funds can be withdrawn tax-free at retirement age.

However, depending on your circumstances, transfers from UK pension schemes may incur additional HMRC tax charges or generate a New Zealand tax liability. It is recommended that you seek tax advice.

Where can I find more information?

More information about transferring UK pensions is provided in the MAS Retirement Savings Scheme Product Disclosure Statement and Other Material Information.

Medical Funds Management Limited is the issuer of the MAS Retirement Savings Scheme. The Product Disclosure Statement is available at Retirement Savings Scheme PDS. MAS is a financial advice provider. The Financial Advice Disclosure statement is available at Financial Advice Disclosure - MAS.